pay utah property tax online

Find case details filing date state parties lien status lien amount and much more. In some cases the property may be auctioned off to pay the contractor.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

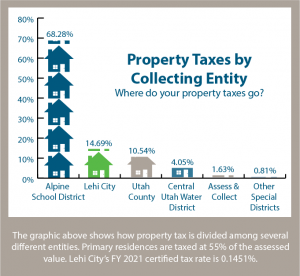

Homeowners in Utah also pay exceptionally low property taxes with an average effective rate of just 058.

. No exemption is allowed for any disability below 10. See administrative rule R865-21U-6. The average effective property tax rate in Utah is the 11th-lowest in the country.

THE KANE COUNTY TREASURERS OFFICE IS RESPONSIBLE FOR COLLECTING TAXES Payments for current and delinquent taxes taxes owed for years 2021 and previous can be paid by following the Payments online link below. Search millions of property tax liens with Infotracers powerful court search tool. Enter your financial details to calculate your taxes.

If you do not have and are not required to have a Utah Sales and Use Tax License you must report the use tax on your personal Utah Individual Income Tax Return or Utah business income tax return Form TC-41 TC-65 TC-20 TC-20S or TC-20MC. Pre-payments for 2022 taxes can be made by mailing a check for the desired amount to our office please include account number or TAKE. 435 634-5703 If a property owner or a property owners spouse claims a residential exemption under Utah Code Ann.

A tax lien may be placed on property and assets by a government tax authority when. Overall taxpayers in Utah face a relatively low state and. If the veteran dies in the line of duty surviving spouse or minor orphan is entitled to property tax exemption of 100 of value of property.

Send a Message Call. Assessor Clay County Assessor Clay County Courthouse 609 East National Ave Room 118 Brazil IN 47834 Phone 812448-9013 Fax 812442-9600. Search Clay County property tax records or pay property taxes online.

Application for Residential Exemption or Request a paper application via. 59-2-1035 for property in this state that is the primary residence of the property owner or the property owners spouse that claim of a. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

This exemption is limited to primary residence or tangible personal property that is held for personal use and not used in a trade or business.

Utah Property Tax Calculator Smartasset

Utah Property Tax Calculator Smartasset

Colorado Property Tax Calculator Smartasset

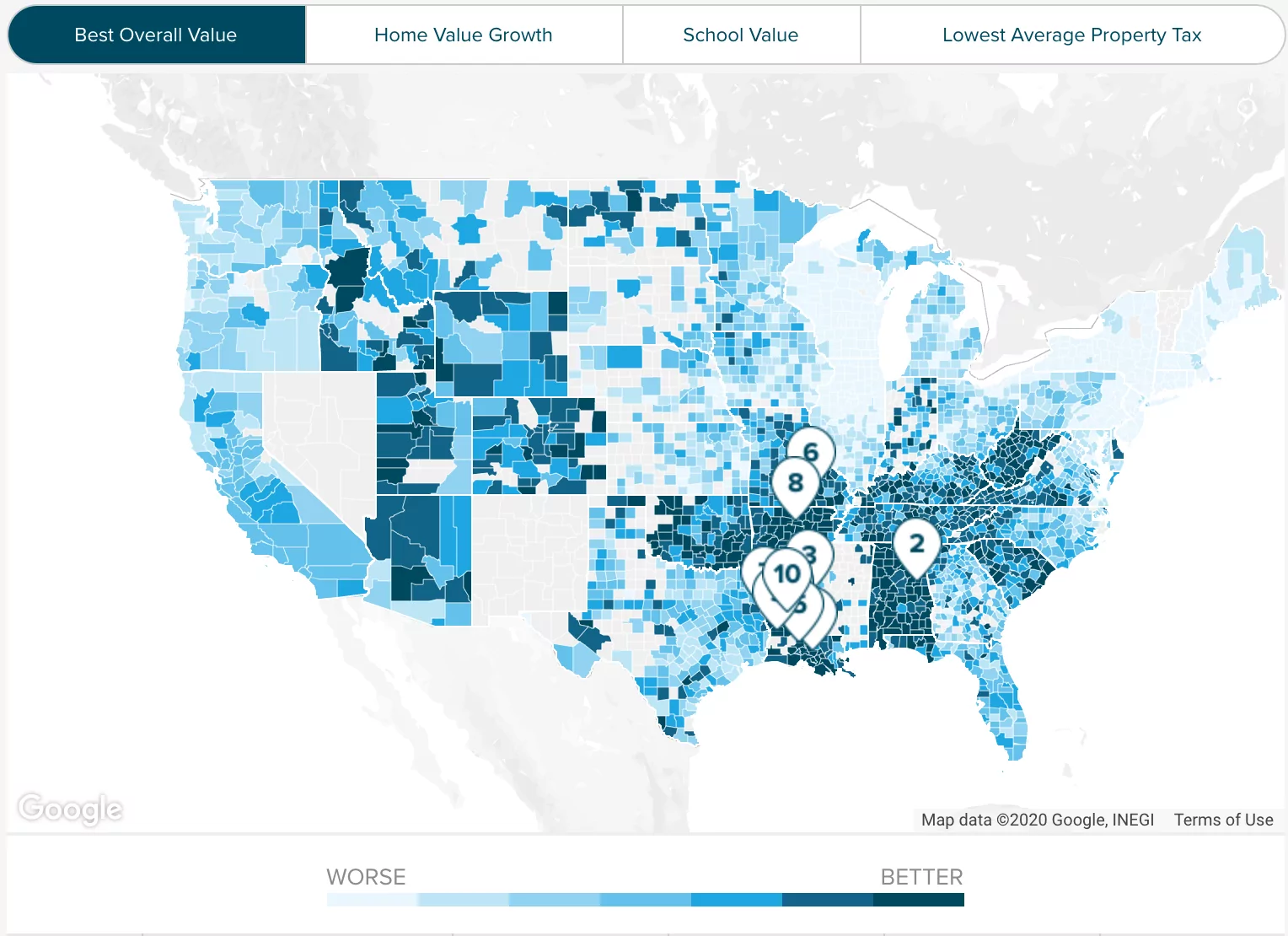

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Fha Loan Calculator Check Your Fha Mortgage Payment

Black Families Pay Significantly Higher Property Taxes The Washington Post

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Utah Property Tax Calculator Smartasset

Payment Options Washington County Of Utah

Guide To Buying A Vacation Property In Park City Utah

Utah Sales Tax Small Business Guide Truic

Payment Options Washington County Of Utah

Riverside County Ca Property Tax Calculator Smartasset

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Pay Taxes Utah County Treasurer

Property Taxes By State Quicken Loans

Utah Homeowners Pay Nearly 40 More Per Month Than Utah Renters